This is for sure a multi-million dollar question. How can we predict which web start-ups will succeed and which will fail?

From an investors’ point of view, this is the consideration that comes into every business decision that gets made, while, for those actually working day and night to get their start-ups off the ground, it’s an even bigger issue.

After all, the rewards can be spectacular – see for example the latest valuations of Facebook, eBay, Groupon and Twitter as evidence of this – but the price of such (perhaps unsustainable) financial possibilities is that competition is fierce and many fail for each one that even moderately succeeds. Web start-ups are still something of a gold rush, despite the fact that they’re now not that new – and we’ve seen it all come crashing down once in the past already…

So, what are the underlying patterns of success to this chaotic and fast-moving sector?

What dictates who makes it to stock market flotation and having apps on your smartphone, and who never even makes it beyond an alpha release?

Are there any rules on how things work in this sense or is it all a random lottery?

Well, of course, it isn’t a lottery – luck and chance do, as always, play some part – but the clear evidence shows that certain business and technical decisions will improve a start-ups chance of success.

Nonetheless, if the actual product is rubbish, then no amount of shrewd acumen will be enough to get you over the line – but, equally, a good product idea is no guarantee of success.

So, what kind of things generally improve a startup’s chances of success – across the board and no matter which particular web sector they’re in?

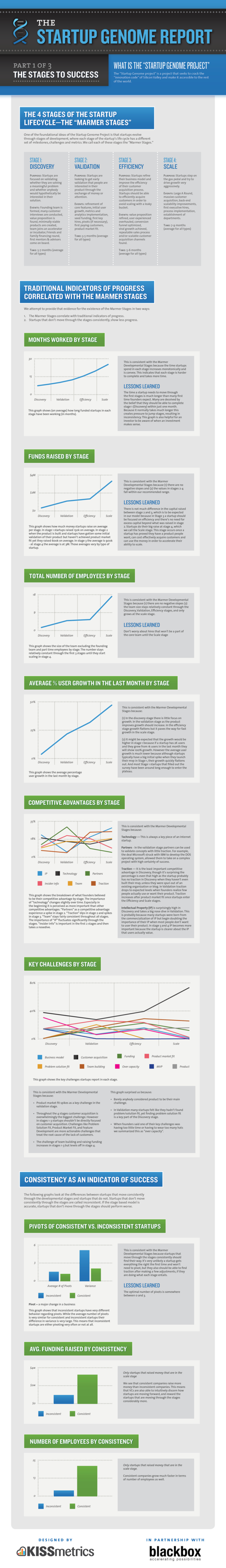

Well, Startup Genome is an excellent organisation which looks exactly at these issues and has recently published the results of an extensive survey of 650 startups to produce this detailed report on recurrent indicators of success.

What makes a web startup succeed?

The general overview of the findings is that there are currently 4 different types of startup models which, broadly speaking, cover the majority of the 650 companies in the survey – and that start-up life-cycles can be broken down into 6 discrete stages (see the report for full info on this). This is all pretty handy for devising precise business strategies which work specifically for your type of startup in a particular stage of its development. However, the most useful section of the report is the section on 14 key factors for success which emerged from the data. Here are some of these important factors:

- Many investors invest 2-3x more capital than necessary – Investors often support startups that haven’t reached problem solution fit yet. They also over-invest in solo founders and founding teams without technical cofounders despite indicators that show that these teams have a much lower probability of success.

- Investors who provide hands-on help have little or no effect on the company’s operational performance – But the right mentors significantly influence a company performance and ability to raise money. However, this does not mean that investors don’t have a significant effect on valuations and M&A.

- Solo founders take 3.6x longer to reach scale stage – This information is compared to a founding team of 2 and they are 2.3x less likely to pivot.

- Balanced teams with one technical founder and one business founder raise 30% more money – They have 2.9x more user growth and are 19% less likely to scale prematurely than technical or business-heavy founding teams.

- Most successful founders are driven by impact rather than experience or money – To put it simply, money is never the top reason for creating a start-up.

- Startups need 2-3 times longer to validate their market than most founders expect – This underestimation creates the pressure to scale prematurely.

- B2C vs. B2B is not a meaningful segmentation of Internet startups anymore because the Internet has changed the rules of business – There are 4 different major groups of startups that all have very different behavior regarding customer acquisition, time, product, market, and team.

As if that weren’t clear, succinct and helpful enough, there’s also a great infographic summarising some of the key data:

N.B. Two caveats: The data refers to Silicon Valley start-ups only. However, bearing in mind how global web start-up products are – the general picture would hold pretty much anywhere.

Secondly, the reason why there are only 4 stages of development for the start-up shown in the infographic, while 6 are mentioned in the report, is that last 2 stages (profit maximisation and renewal) are not covered in detail by the report.

All in all, a very valuable resource – and not one which you would normally expect to have provided for free.